How to Complete Accreditation for Your LLC by Proving All Beneficial Owners Are Accredited

To participate in certain private investment opportunities, your LLC must be verified as an accredited investor per Rule 501(a) of Regulation D of the Securities Act of 1933. One way to achieve this is by proving that all beneficial owners (equity owners) of the LLC are individually accredited. This article outlines the steps to complete accreditation verification for your LLC using Parallel Markets’ streamlined process.

Steps to Verify LLC Accreditation via Accredited Owners

Sign Up or Log In to Parallel Passport

If you’re a new user, create an account by providing your email, name, and a secure password, then confirm your email.

If you’re an existing user, log in to your Parallel Markets account.

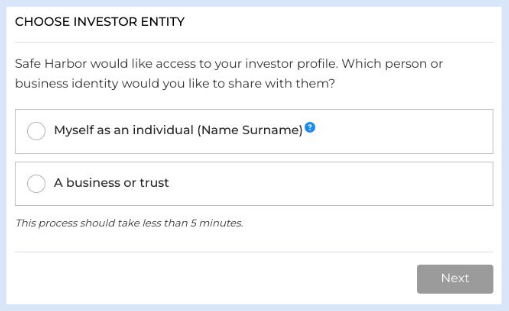

Select Your Business Entity

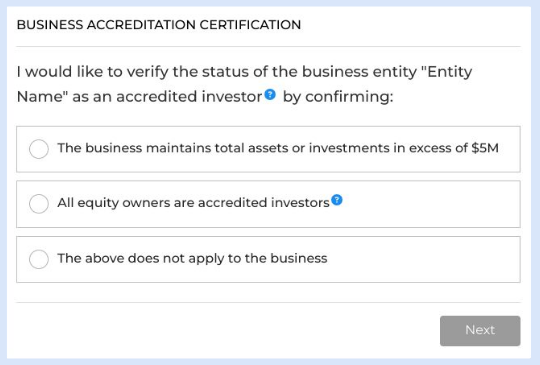

Choose Accreditation Path

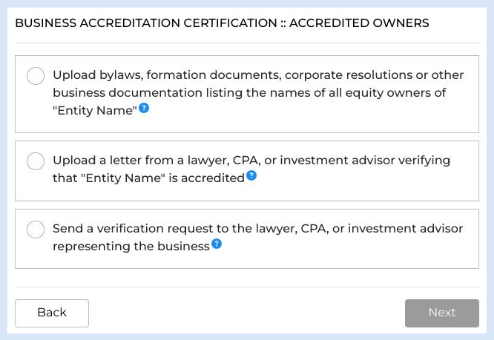

Upload Ownership Documentation

Provide bylaws, operating agreements, formation documents, or corporate resolutions listing the names of all equity owners of the LLC.

You may upload up to 10 files, ensuring they are clear and dated within the last 90 days.

Certify that the uploaded documents accurately and completely list all equity owners.

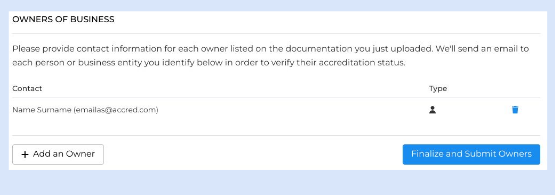

Provide Contact Information for Each Owner

Authorize Data Sharing

Authorize Parallel Markets to share your LLC’s accreditation data with the partner platform (e.g., Safe Harbor) by clicking “Authorize.”

Ensure you review the partner’s Privacy Policy and Terms of Service.

Individual Accreditation for Owners

Each equity owner must complete their individual accreditation verification by one of the following methods:

Income: Provide tax documents (e.g., W2s, 1040s) showing income of $200,000 individually (or $300,000 jointly with a spouse) for the past two years, plus expected income for the current year.

Net Worth: Submit asset statements (e.g., bank/brokerage statements, property appraisals) and a credit report showing a net worth of $1M (excluding primary residence).

Professional License: Provide a valid CRD number for a Series 7, 65, or 82 license in good standing with a FINRA member firm.

Evaluator Letter: Upload a letter from a licensed CPA, attorney, SEC-registered investment advisor, or enrolled agent, dated within 90 days, confirming the owner’s accredited status.

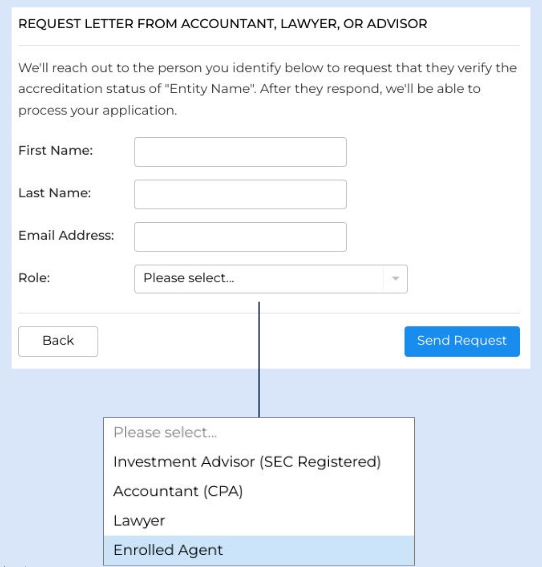

Alternatively, owners can request an evaluator to verify their status by providing the evaluator’s contact details (name, email, role).

Review and Submit

Verify that all owner information and documents are accurate.

Submit the accreditation application. Parallel Markets will review it within one business day.

Alternative Accreditation Options

If not all beneficial owners are accredited, your LLC can still qualify as an accredited investor by:

Proving total assets or investments exceed $5M (via financial statements or an evaluator letter).

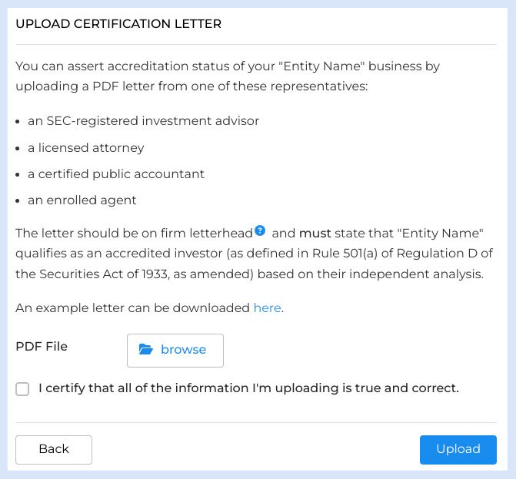

Uploading an evaluator letter from a CPA, attorney, or investment advisor confirming the LLC’s accreditation status.

Important Notes

Beneficial Owners: All equity owners must be individually accredited for this path. Ensure documentation clearly lists all owners.

Evaluator Letters: Letters must be on firm letterhead, dated within 90 days, and explicitly state the LLC or owner qualifies as an accredited investor per SEC regulations.

Certification Validity: Accreditation letters are valid for 90 days per SEC rules. For income-based verifications, you may need to reaffirm expected income annually.

LLC Owned by a Trust: If the LLC is owned by a trust, the trust’s grantors or beneficial owners must be accredited, and their accreditation must be verified individually.

Need Help?

Refer to Parallel Markets’ FAQ page or contact their support team (help@parallelmarkets.com) for assistance with document uploads, evaluator requests, or other issues. An example evaluator letter is available for download on the platform to guide your CPA or advisor. For anything else, please contact support@digitalwealthpartners.net.